RECKITT'S RESPONSIBLE APPROACH TO TAX

Tax regulation around the world is increasingly complex. It’s therefore important that business supports efforts to increase trust and understanding of the tax system. In the UK, all large companies are required to publish their Tax Strategies annually. We are fully aligned with His Majesty’s Revenue & Customs’ (HMRC) goal of improving tax transparency and follow a clearly defined and rigorously monitored Tax Policy, the principles of which are outlined in our Tax Strategy Report here.

Download our 2024 Tax Strategy Report

This year we are publishing our EU Country by Country reporting in line with the latest regulations.

Reckitt by numbers

We operate in over 60 countries across six continents, and our products are sold in nearly every country in the world.

Tax Paid

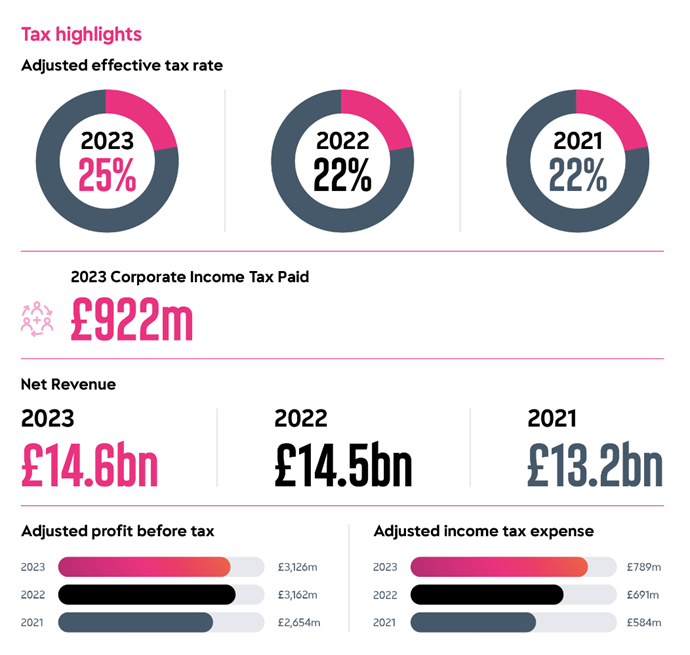

In the year ended 31 December 2023, the Group paid £922m in corporate income tax worldwide. In addition to taxes generated, Reckitt also contributes to the economy. We create employment, develop workforce skills, make capital investments, purchase goods and services – from local suppliers where possible – and make direct social impact investments.

See our latest sustainability reportReport Archive

2023 EU Country by Country Report: Table 2 and Table 3

Download PDFRaportul public UE pentru fiecare ţără în parte

Download PDF2023 tax strategy

Download PDF2022 tax strategy

Download PDF2021 tax strategy

Download PDF2020 tax strategy

Download PDF2019 tax strategy

Download PDF2018 tax strategy

Download PDF

![[object Object]](/static/955ca00b4b7d89447c6dabde64be6d86/a764f/b7a0ef929c6dadd43f502ab204d6eef271602da6.jpg)